Understanding Forex Trading Times A Comprehensive Guide 1790612829 Leave a comment

The world of forex trading is dynamic and ever-evolving, making it essential for traders to understand the importance of timing. Knowing when to trade can significantly impact your trading success. In this article, we delve into forex trading times, their significance, and how to optimize your trading hours. Additionally, for those interested in trading in specific regions like Africa, you can find useful information about forex trading times Forex Brokers in Uganda.

The Basics of Forex Market Hours

The forex market is open 24 hours a day, five days a week, allowing traders from all around the globe to participate. The market operates in three major trading sessions: the Sydney session, the Tokyo session, and the London session. Each of these sessions has distinct characteristics that affect market behavior and volatility.

Trading Sessions and Their Characteristics

1. Sydney Session

The Sydney session opens first at 10 PM GMT and runs until 7 AM GMT. This session generally sees lower volatility as it overlaps with the end of the Asian trading day. However, it can provide opportunities, particularly for pairs that include the Australian dollar (AUD).

2. Tokyo Session

The Tokyo session begins at 12 AM GMT and ends at 9 AM GMT. This is where significant trading in JPY pairs occurs, and market volatility can pick up as the session progresses. Traders focusing on Asian markets and currencies should be attentive during this period.

3. London Session

The London session opens at 8 AM GMT and closes at 5 PM GMT. This session is one of the most active in the forex market, with high liquidity and volatility. The overlap between the London and New York sessions (from 1 PM to 5 PM GMT) is particularly notable, as it often sees the most trading activity for the day.

4. New York Session

The New York session kicks off at 1 PM GMT and wraps up at 10 PM GMT. Similar to the London session, it presents numerous trading opportunities, especially for participants looking to trade the major currency pairs. The influx of economic news releases often occurs during this time, further increasing volatility.

The Importance of Trading Times

Understanding trading times is crucial for effective forex trading. Here are several reasons why timing matters:

- Liquidity: Different times of the day attract various levels of liquidity. Higher liquidity generally leads to tighter spreads, benefiting traders.

- Volatility: Certain sessions are prone to higher volatility, increasing the potential for larger price movements.

- News Releases: Economic news often impacts trading patterns. Knowing when these releases occur can help traders position themselves advantageously.

- Market Overlaps: Times when sessions overlap typically experience more trading activity, providing more opportunities for traders.

Optimal Trading Times

To maximize potential profits and minimize risks, traders often choose to operate during specific times. The most favorable trading hours typically fall within the overlap periods of the major sessions. Here are the most effective trading times:

- London/New York Overlap (1 PM – 5 PM GMT): This is widely considered the best time to trade due to the high volume of transactions and volatility.

- Asian Trading Hours (Tokyo session): For traders interested in currencies like JPY, this session offers ample opportunities.

- Early London Session (8 AM – 10 AM GMT): This period often sees significant movement as European markets open.

Strategizing Your Trading Hours

Choosing the right trading hours is just one aspect of a comprehensive forex trading strategy. Here are some tips to consider:

- Monitor Economic Calendars: Keep a close eye on scheduled news releases and economic events that might affect market behavior.

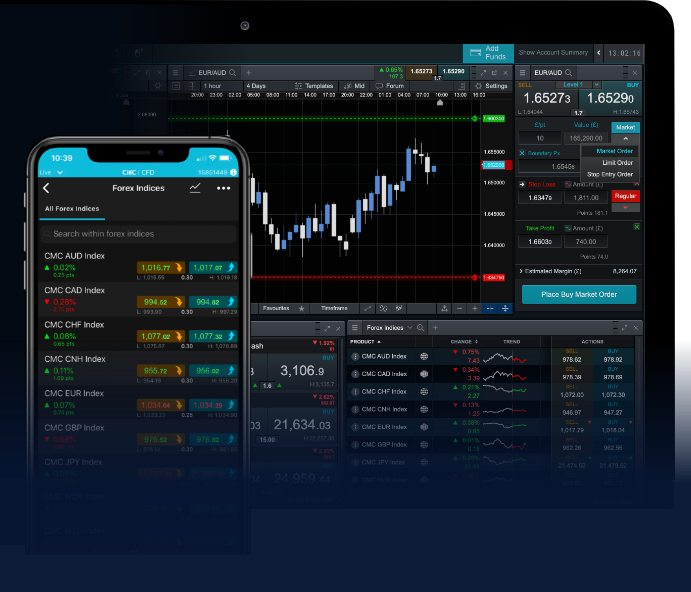

- Use Technical Analysis: Analyze charts to identify patterns, trends, and potential entry and exit points that align with your chosen trading times.

- Risk Management: Set clear stop-loss and take-profit orders based on market conditions during your selected trading hours.

- Stay Informed: Continuously educate yourself about market trends and events that might influence currency movements.

Conclusion

Understanding forex trading times is critical for developing effective trading strategies. By identifying optimal trading hours, considering market volatility, and staying informed about economic conditions, traders can enhance their chances of success. Whether you’re a novice or an experienced trader, learning how to navigate the forex market’s hours can be the key to unlocking your trading potential.