Understanding Forex Currency Trading Brokers A Comprehensive Guide 1924231047 Leave a comment

Understanding Forex Currency Trading Brokers: A Comprehensive Guide

The world of forex trading can be both exhilarating and overwhelming, especially for newcomers looking to make their mark in this dynamic financial market. A crucial element in this journey is selecting the right forex currency trading broker, which serves as the gateway to the global forex market. In this comprehensive guide, we will delve into the role of forex brokers in currency trading and provide insights on what to consider when choosing the right broker for your trading needs. Additionally, you can explore forex currency trading broker protradinguae.com for further resources and support.

What is a Forex Broker?

A forex broker is an intermediary that facilitates the trading of currencies for retail traders, institutions, and banks. They act as a bridge between the traders and the forex market, allowing traders to buy and sell currency pairs through the use of a trading platform. Brokers earn revenue through spreads (the difference between the buying and selling price) or by charging commissions on trades.

Types of Forex Brokers

Forex brokers fall into several categories, each catering to different trading styles and needs. Understanding these types can help you find a broker that aligns with your trading goals.

1. Market Makers

Market makers are forex brokers that provide liquidity by creating a market for traders. They quote both a buy and sell price for currency pairs, making profits from the spread. Market makers can have advantages for traders, such as fixed spreads and better execution during volatile market conditions.

2. STP (Straight Through Processing) Brokers

STP brokers route orders directly to the interbank market, where they are filled at the best available prices. This type of broker usually offers variable spreads, which can be more favorable in certain market conditions. STP brokers are known for providing greater transparency and execution speed.

3. ECN (Electronic Communication Network) Brokers

ECN brokers connect traders to a network of liquidity providers, allowing direct execution of orders. They typically charge a commission on trades rather than having a spread, making them ideal for traders looking for low latency and competitive pricing. ECN brokers are favored by high-frequency and institutional traders.

Factors to Consider When Choosing a Forex Broker

Selecting the right forex broker is essential for your trading success. Here are several critical factors to consider:

1. Regulation and Safety

Ensure that the broker is regulated by a reputable authority in the finance industry, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. Regulatory oversight helps protect your funds and ensures fair trading practices. Look for brokers who segregate client funds and offer negative balance protection.

2. Trading Costs

Understanding the fees associated with trading is essential. Different brokers have varied commission structures, spreads, and additional fees (such as withdrawal fees). Compare these costs to determine the most economical choice for your trading strategy.

3. Trading Platforms and Tools

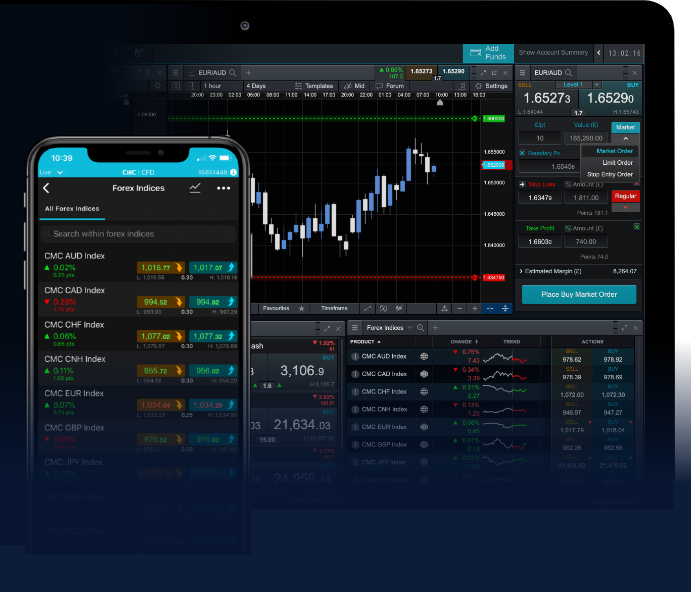

The trading platform is where you’ll execute trades, so it’s important to choose a broker that offers a robust and user-friendly platform. Look for features like technical analysis tools, charting capabilities, and order types that fit your trading style. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms.

4. Customer Service

Access to reliable customer support can significantly impact your trading experience. Ensure that the broker offers multiple channels for support, including live chat, email, and phone. Test their responsiveness during the account opening process to evaluate their service quality.

5. Education and Research Resources

Many brokers offer educational materials to help traders improve their skills and knowledge. Look for educational resources such as webinars, articles, trading guides, and market analysis to enhance your trading strategies.

Conclusion

The forex trading landscape is vast and ever-evolving, making the role of brokers indispensable. By understanding the different types of brokers and considering various factors when selecting one, you can make informed decisions that align with your trading objectives. Take your time to research and compare brokers to find one that suits your needs, ensuring a smoother trading journey. Always remember that trading involves risks, and proper education and preparation are critical for successful trading.

In conclusion, forex currency trading brokers play a pivotal role in accessing financial markets, and choosing the right broker can significantly influence your trading performance. As you embark on your trading journey, leverage resources available online, like protradinguae.com, to maximize your knowledge and trading skills.