Choosing the Right Forex Trading Brokers A Comprehensive Guide 1954092094 Leave a comment

When venturing into the world of Forex trading, one of the most crucial decisions you will make is choosing the right broker. Your broker acts as the intermediary between you and the Forex market, so it’s essential to find one that aligns with your trading goals and offers the services you need. For thorough insights, you can refer to forex trading brokers Global Trading Brokers, which provides valuable information on brokers available in the market. In this guide, we will explore the key factors to consider when selecting Forex trading brokers, the different types of brokers available, and tips to ensure you pick the right one for your trading journey.

Understanding Forex Trading Brokers

Forex trading brokers facilitate the buying and selling of currency pairs on behalf of their clients. These brokers can be broadly classified into two categories: market makers and ECN (Electronic Communication Network) brokers. Market makers provide liquidity by creating a market for traders, which means they can quote both buy and sell prices and often act as the counterparty to their clients’ trades. ECN brokers, on the other hand, connect traders directly to the interbank market, providing faster execution times and tighter spreads, which many experienced traders prefer.

Types of Forex Brokers

There are several types of Forex trading brokers, each with unique features and benefits:

- Market Maker Brokers: These brokers set their prices and often profit from the spread between buy and sell prices. They may offer guaranteed execution at specific prices, which is advantageous for novice traders.

- ECN Brokers: By connecting clients to the interbank system, ECN brokers typically offer lower spreads and faster execution speeds. They charge a commission on trades, which can be a more cost-effective option for frequent traders.

- STP (Straight Through Processing) Brokers: STP brokers route client orders directly to liquidity providers, allowing for quicker execution compared to market makers. They often have variable spreads, depending on market conditions.

- DMA (Direct Market Access) Brokers: These brokers provide traders with direct access to the market, usually suited for institutional traders or very active retail traders.

Key Factors to Consider When Choosing a Forex Broker

When evaluating Forex trading brokers, certain factors can significantly influence your trading experience. Here are some essential features to consider:

1. Regulation

Regulatory compliance is crucial in Forex trading. A regulated broker is more likely to adhere to industry standards, providing a layer of security for your funds. Look for brokers regulated by reputable authorities like the Financial Conduct Authority (FCA), the Commodity Futures Trading Commission (CFTC), or the Australian Securities and Investments Commission (ASIC).

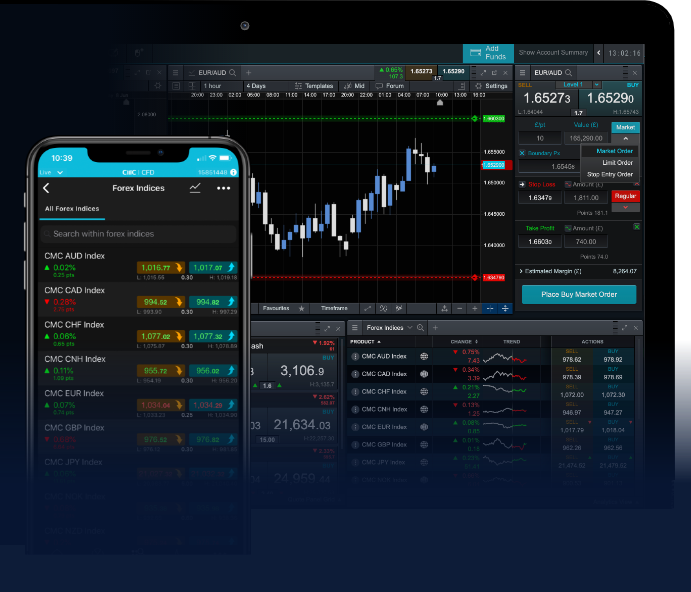

2. Trading Platform

The trading platform is your primary interface with the Forex market, so usability and functionality are paramount. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer advanced charting tools, automated trading capabilities, and a user-friendly interface. Ensure the broker provides a platform that suits your trading style.

3. Trading Costs

Understanding the costs associated with Forex trading is critical. Brokers typically earn through spreads and commissions. Compare the costs across various brokers to find one that offers competitive rates without compromising on the quality of service.

4. Customer Support

Reliable customer support is essential, especially for new traders who may need assistance. Check if the broker offers multiple channels of communication, including chat, email, and phone support, and whether their support team is knowledgeable and responsive.

5. Account Types

Many Forex brokers offer various account types tailored to different trading needs. For example, some may cater to beginners with micro or standard accounts, while others provide features for advanced traders, such as cent or swap-free accounts. Ensure the broker you choose offers an account type that meets your trading requirements.

6. Educational Resources

The best brokers often provide educational resources to help traders improve their skills. Look for brokers that offer webinars, tutorials, market analysis, and demo accounts to practice without risking real money.

7. Deposit and Withdrawal Options

Examine the broker’s funding options, including the deposit and withdrawal methods available. Make sure they offer convenient options that suit your preferences, and check for associated fees and withdrawal times, as these can vary significantly among brokers.

Evaluating Broker Reviews and Reputation

Before committing to a Forex broker, it’s vital to do your research. Look for broker reviews on trustworthy websites, forums, and social media to gauge the experiences of other traders. Pay attention to factors like execution speed, customer service quality, and overall reliability. Additionally, prospective traders should consider how long the broker has been operating; established brokers often demonstrate experience and stability.

Conclusion

Choosing the right Forex trading broker is a foundational step towards a successful trading experience. By understanding the different types of brokers, key factors to consider, and evaluating reviews, you’ll be better equipped to select a broker that caters to your specific needs. Remember, a good broker can facilitate your trading journey, while a poor choice can lead to unnecessary challenges and losses. Take the time to conduct thorough research, and don’t hesitate to leverage resources like Global Trading Brokers to inform your decision-making process.